Question from one of our Young Readers:

Puede po bang turuan nio ako about time deposit, kasi first time ko pa lang sa mga bagay na ganito. Sana po magbigay kayo ng examples galing sa sarili ninyong time deposits.

Answers:

Ang Time Deposit ay isang uri ng bank account na puede mong i-open sa bangko kapag meron kang malaki o medyo malaking pera na gusto mong itago at palaguin. A Time Deposit earns much more than what a regular savings deposit can earn.

Puede kang mag-time deposit ng 20k, 30k, 50k or more. Tumatanggap din ang bank ng smaller amounts katulad ng 1k o 5k, pero kapag ganito pa lang ang amount, ilagay mo na lang muna ito sa savings account mo, dagdagan mo, at palakihin mo up to mga 20k or more, then ilagay mo sa time deposit.

Bring 2 valid IDs. Kung wala ka pang savings account sa kanila, they will ask you to open a savings account to serve as your Settlement Account. Dito ilalagay ng bank ang money at interest earned mo kapag wiwidrohin mo na ang pera mo.

Why is the interest higher? Because you will keep your money in the bank in a fixed period of time, such as 3 months, 6 months, 9 months, 1 year or more years. No withdrawal before the fixed term.

But in case, there’s an emergency need, you can withdraw before the maturity date, but your earnings for the term not completed will be reduced.

Puedeng automatic renewal to another fixed term. This is better, in case you forget or you don’t have time to renew your deposit.

This is a sample Time Deposit Certificate:

What data items are in the Time Deposit Certificate?

Name of the Bank and Branch

Time Deposit Certificate No.

Account No.

Name and Address of Depositor

Type: Auto-Renew

Amount of Time Deposit

Term

Opening Date

Maturity Date

Interest Rate

Interest Payment Schedule

Settlement Account No.

Signature of Bank Representative

Signature of Depositor

Banks send you a Renewal Notice through Registered Mail or a private courier.

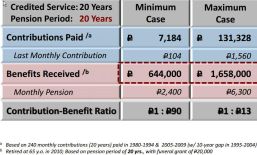

Sample Time Deposit Renewal Notice

What data items are in the Time Deposit Renewal Notice?

All the data items in your Time Deposit Certificate are in the notice.

What are added are:

Date of latest renewal

Number of times renewed

Net Interest

Current Balance

Interest Rate for the Next Term

Sample Earnings:

Amount Deposited: 200,000 pesos

Date Opened: March 3, 2011

Term: 182 days

No. of Times Renewed: 4

Latest Renewal Date: February 29, 2013

Total Net Interest: 9,465.31 pesos

Current Balance: 209,465.31 pesos

Suggestion: Put your time deposit in a bigger savings bank. Usually, savings banks offer higher interest rates than commercial/universal banks.

Huwag mag-time deposit sa mga rural banks na nag-o-offer ng 5% o 6% o 7% annual interest rate. Hindi nila kakayaning kitain yan para maibigay sa iyo. Kadalasan, ang mga naba-bankrupt na banks ay ang mga rural banks dahil kulang sa capital, talo sa competition sa industriya, mismanagement, o banking violations ng mga managers and/or owners.